Very simply Colec is you magnified by our abilities. Colect properties targets high cash flow fixed properties or estates that would normally be out of reach but pooling the capital resources of investors and leveraging on the skills sets of the founding member's to manage and grow these portfolios. We seek out the financing to leverage the portfolio to continue the exponential growth of the portfolio continually reducing risk and growing returns.

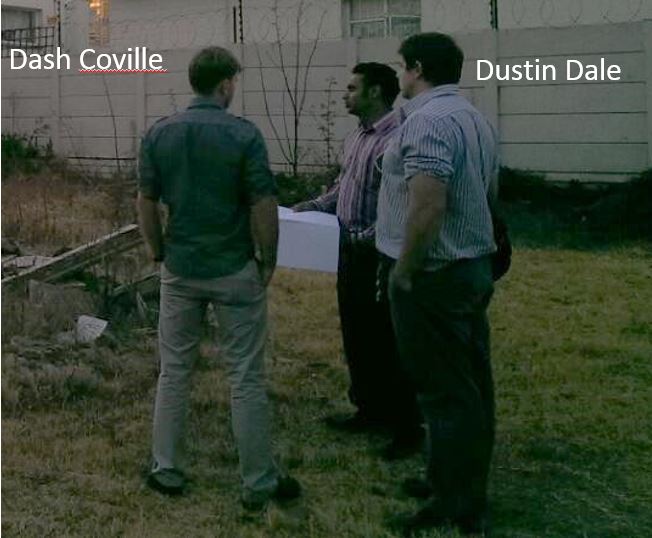

Dash comes from a civil engineering background and has worked with developing and upgrading existing buildings. His input in evaluating the future value and input cost of a property are invaluable to finding the correct returns in the first startup. He specializes in green design which help to reduce running and maintenance cost of a building to optimize the cash flows.

Dustin Dale: Executive Director and founder

Dustin has a mechanical engineering degree and has several years experience in project engineering and management. Working with projects from concept to final product including building, factories and machinery. He has been investing and working with property since 2010 and has a growing personal portfolio. “Now the time it to look to bigger and greater things.”

The concept is simple. Fixed property is a great investment and will grow at or above inflation when averaged over time. They two largest problems with property are capital, whether from financing or your pocket, and the cash flow. Generally property is used to leverage on the capital growth but often but financing out of you pocket to keep it going while this accumulates in the background. Then to realize this the property must be sold or re-leverage to the banks.

Colec properties tries to turn this on its head. We aim to generate positive cash return while still leveraging to gain the benefit of great growth. How do we do this. We target the growing market in the revitalization of the JHB city center. This market has high cash flow yielding properties meaning a heath flow out to investors. Properties can be bough under value and with small or large renovation yielding large growth and a huge demand for the accommodation. Meaning an accessible and reliable market.

The catch, to break into these markets can require large upfront capital to purchase at the best price and fast turnover in upgrades and this is where the collective investment come in. Instead of asking a financial backer to provide the capital and taking a large portion of the return for themselves, we open the market to you so you can access the growth. And once the portfolio has grown the current assets can be used to gain financing from the banks to fund the next project.

We are currenlty doing an initial offering!

Feel free to download and read read through our proposal and forcast. If you interested simply make contact with us via email or telephone to be put on the contact list for the initial share release.

Feel free to contact us to discuss our upcoming share release or simply ask some questions!